DATAVAULT™ is AFFLUENTIAL's™ proprietary data repository. DATAVAULT™ offers a superior user experience, advanced functionalities to browse AFFLUENTIAL™ data products and deep dive into our data through clear visualisations. Clients can further save their findings and disseminate them across the organization.

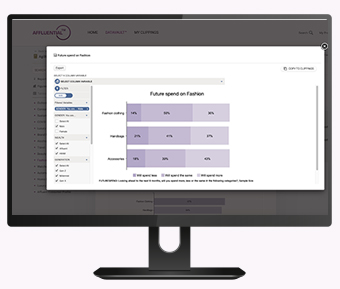

Insights Engine™ sits at the heart of DATAVAULT™ and allows clients to customise, interact, and download AFFLUENTIAL™ data. Subscribers can personalise their data views and use the insights engine to find answer to their most pressing business questions. Insights Engine is powered at the backend by our team of data scientists and analysts..

LuxeTalk™ is our proprietary digital luxury community built over the last 10 years with thousands of emerging affluent, affluent, high-net-worth (HNW) and ultra-high-net-worth consumers (UHNW) across 38 markets and growing.

The A³ team works across deeper analytics engagements for clients with over 500 successful user case experiences. The team also develops the AFFLUENTIAL™ Luxury Brand Affinity (ALBA) score, an authoritative ranking of premium and luxury brands for 12 different metrics which is highly recognized by global media and the industry.

WE HELP YOU THROUGH DEEP DATA SCIENCE, INSIGHTS, ANALYTICS

AND CONSULTING SOLUTIONS.