A Whole New World: the Affluent Asian Traveller

Our latest data results highlight the Top 3 future purchases for Affluent Asians: Travel Experiences, Hotel Accommodation, and Air tickets. For Affluent Chinese, almost 4 in 5 plan to spend money on travel experiences. These insights, derived from Agility’s annual Affluent Insights Travel Consumer Report, indicate a very positive outlook for the luxury travel market and a growing demand for luxury travel experiences and luxury purchase during travel by Affluent Asians.

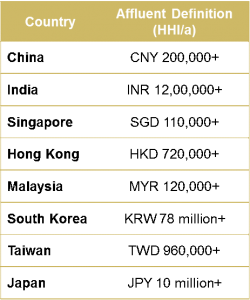

The research, conducted on 2441 affluent individuals in 8 key Asian markets shown in Figure 1, also uncovered that the majority of Affluent Asians are passionate in trying new things (a key driver for travel) and exploring new destinations and cultures, especially theculture’s culinary heritage. 77% of them are keen on gastronomic experiences – trying out local cuisine and savouring local produce–making this the number one most preferred travel activity, even topping shopping.

Figure 1. 8 Asian Markets and Affluent Definitions. Agility Affluent Insights 2016.50% of Chinese above 350,000 Yuan and 10% above 1 million Yuan HHI

Where will these Affluent Asians be travelling to in the future? The top 3 future destinations turn out to be Tokyo, Osaka, and Hong Kong. The favorability of the weak Yen, Japan’s proximity to many other countries in Asia, and its reputation for unique cultural traditions and natural beauty may contribute to what makes the country an attractive destination. This is especially for those who seek something new and exciting. Travel activities done in Japan include skiing and hot springs, aside from sightseeing and trying out authentic Japanese cuisine.

Some variations of desired travel destinations and experiences exist among different countries. For Affluent Chinese, Maldives is the number 1 top planned future travel destination, a testament to the island country’s commitment and efforts to attract more tourists from Asia. For the Chinese, nature experiences and eco-tourism are in the top 3 desired travel activities, different from other countries surveyed. For Affluent Japanese, perhaps not too surprisingly, Hawaii remains the number one travel destination.

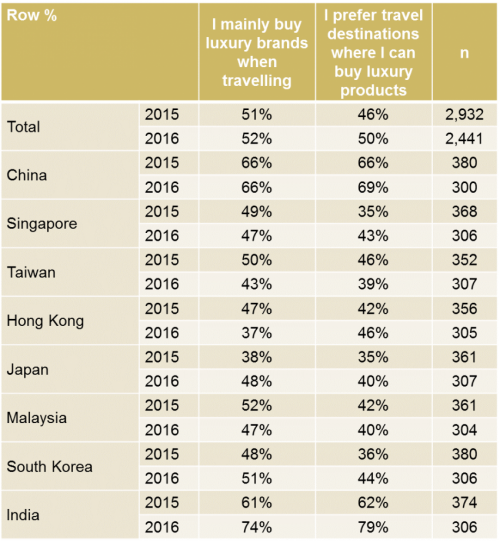

Even though shopping activity has been topped by gastronomic experiences, luxury goods brands need not to worry about the opportunities arising from these travelers: more than 1 in 2 Affluent Asians mainly buy luxury goods when travelling. In fact, more than 1 in 2 Affluent Asians deliberately prefer to choose destinations where they can buy luxury products. This is a slight increase from 2015 (figure 2). In Tokyo, they can stroll along the Shibuya District and be greeted by their favorite luxury brands. In Hong Kong, they can cool down from the summer heat inside one of the air conditioned luxury shopping malls in Causeway Bay. However, luxury goods brands need to anticipate (and act on) the influx of more Asian travelers to Osaka, a city not generally known for its reputation as a shopping destination.

Figure 2. “Please rate how strongly you agree with each of the following statements.” (Completely agree + Somewhat agree) Base: Total sample; n = 5373, Source: Agility Affluent Insights 2015 and 2016.

Hotels and airline brands will definitely benefit from the fact that 7 in 10 Affluent Asians plan to travel more luxuriously in the future. More than 1 in 2 Affluent agree that they only stay in 4-5 star hotels when travelling and there is generally a trend in upgrading airline class service as compared to 2015 (e.g. from business to first). The future of luxury accommodation, both on land and in air, is filled with opportunities arising from travelling Affluent Asians, for both leisure and business trips. On average, about 4 trips are taken annually, 2 for business and 2 for leisure. Affluent Singaporeans have the highest average of leisure trips taken with 3.1 trips in the past 12 months. Affluent Indians, on the other hand, have the highest average of business and BLEISURE (business and leisure) trips taken with 3.3 and 2.8 trips, respectively.

Figure 3. “Please rate how strongly you agree with each of the following statements about your travel preferences” (Completely agree + Somewhat agree) Base: Total sample; n = 2441 Source: Agility Affluent Insights 2016.

Social media is the most popular source of awareness for airlines and hotels. Websites like Facebook, Google+ and Instagram are all lucrative channels where brands can look into, especially to lure in the young, digitally savvy, and social AAA travelers. In China; WeChat and Sina Weibo are significantly more popular than Facebook and the like. In addition, 81% of Affluent Asians research about travels online and 77% of them book their travels online. All of this means that brands’ digital presence is more crucial than ever.

To sum it up, the future demand for luxury travel experiences and luxury shopping during travels remain strong. A key insight amongst many from our Travel Report is that these Affluent Asians travel for one main purpose: to explore a new destination, something beyond their routine day to day work schedules, and to try new experiences. Consistent to what many marketing experts say about the current zeitgeist: people want to purchase valuable one of a kind experiences, more than material things

When brands recognize this, they can find ways to innovate and capitalize: Ie: make special limited edition items available only in some destinations (cherry blossom inspired collection, anyone?); create a truly localized hotel staying experience; collaborate with restaurants in the travel destination for business class dining. These consumer are finding novel ways to escape the average and elevate their senses. After all, isn’t that what luxury is truly about?

So here you have above an appetizer version of what our travel reports cover. To find out more and uncover deeper insights, data and research findings by market and brand please look into our one of a kind Travel Subscription Service below.

Affluent Insights 2016 Travel Subscription Service

At Agility Research and Strategy, we strive to research the most up to date and relevant trends and behaviors in the ever-changing world of luxury goods and travel in Asia and beyond. We are here to work with brands like yours in exploring to see around the corner and grow your market share in the thriving Asian consumer landscape.

Every year, our annual Affluent Insights Travel Subscription offers detailed insights on Affluent Asian travelers in 8 key markets: China, HK, Taiwan, Japan, South Korea, Singapore, Malaysia and India. Brands get to find out about the destinations these consumers plan to travel to, the hotels they are staying in, the brands they love, and the pain points and challenges that need to be expected by marketers, and more. Our dedicated experts and team of consultants are also available to support you through our custom data tabulation service and brainstorming sessions. For more information on the 2016 Affluent Insights Travel Subscription Service, click HERE.

Previous Post

Previous Post